2026 is shaping how people think about property investment in Anambra State. One question stops beginners before they invest: What is the real cost of starting in real estate? Online estimates may sound attractive, yet many overlook important details.

Therefore, the truth is simple. Starting a real estate business in Anambra costs more than buying land. Moreover, beyond the advertised price, documentation fees, verification costs, and setup expenses apply. Many first-time investors discover these costs only after paying part of their capital.

However, this guide explains the true cost start real estate in Anambra in 2026. It separates the lowest entry cost from the realistic startup cost. It also shows where beginners often make costly mistakes.

Understanding Real Estate Entry Costs in Anambra

Starting real estate in Anambra is not a single payment decision. For instance, many beginners focus only on land price and ignore the rest of the cost start real estate. That gap in understanding is where most early problems begin.

Entry costs cover ownership, verification, and positioning a property for growth. Meanwhile, these include land or property sale, legal documentation, verification, and initial setup. Each item increases your budget and affects how your investment performs.

In 2026, entry costs vary across Anambra. Urban locations demand higher capital but offer speed and clarity. Developing areas lower initial cost but need patience. Knowing these differences helps you match your budget to the right strategy.

Why do Real Estate Startup Costs Vary Across Anambra

Real estate costs vary because demand and infrastructure are uneven across the state. Areas with good roads, electricity, schools, and commercial activity attract higher prices. At the same time, these locations reduce future delays and risk.

Additionally, developing areas cost less to enter but lack full infrastructure. Investors pay less upfront but wait longer for appreciation or rental demand. This waiting period is part of the real cost start real estate.

Therefore, seller type also matters. Individual sellers may offer lower prices but need deeper checks. Registered companies charge more but simplify documentation. These trade-offs explain why startup costs differ across Anambra.

Smallest Capital Required to Start Real Estate in Anambra

Many people searching in 2026 want a simple number. They ask for the smallest cost start real estate in Anambra and expect one figure. In reality, the smallest capital depends on how you choose to enter the market.

At the smallest, the cost to start real estate covers land, documents, and verification. On the other hand, this approach suits beginners who want to learn and grow bit by bit. But it also requires patience and careful planning.

Higher entry capital allows faster deployment. In summary, it reduces delays, lowers documentation risk, and shortens the time before returns begin. Understanding these levels helps you avoid underfunding your first investment.

Entry-Level Investment Options for Beginners

Entry-level options keep the cost start real estate manageable. One common path is buying land in developing areas. Prices are lower, and payment plans may be available. The trade-off is time, as infrastructure and demand build over time.

Another option is purchasing from registered real estate companies. This route costs more upfront, yet reduces verification stress. Documentation is often clearer, which protects beginners from disputes.

Joint ventures also reduce individual capital pressure. Investors pool funds and share ownership. Clear agreements are essential to protect everyone involved.

When Cheap Real Estate Becomes Risky

Very low prices often hide problems. Often, a low cost start real estate signals unclear titles or access issues. These problems usually surface later and increase the total cost.

Common risks include boundary disputes, incomplete surveys, and unverified sellers. Early savings disappear once legal fixes and delays add up.

A safer approach balances price with clarity. Spending more at the start often protects capital and keeps projects moving.

Cost of Land Acquisition in Anambra

Land buy takes the largest share of the cost start real estate in Anambra. Prices change in short order, and location plays a major role. Many beginners underestimate this stage and fall short before documentation.

In 2026, land cost reflects access, demand, and title clarity. Areas close to roads and services cost more but save time later. Cheaper locations lower entry cost but extend holding periods. Knowing this trade-off helps you choose land that fits your budget and timeline.

Price Differences Between Urban and Developing Areas

Urban locations command higher prices because demand is constant. These areas offer faster development, quicker resale, and stronger rental prospects. As a result, the cost start real estate rises, but risk often falls.

Developing areas cost less upfront. Investors pay lower prices and can enter with smaller capital. Yet, infrastructure arrives with a delay. Appreciation and rentals take longer to materialise. Patience becomes part of the investment cost.

Choosing between these options depends on strategy. Speed favours urban zones. Long-term growth favours developing locations.

Hidden Costs Buyers Often Overlook

Land price is not the final figure. Extra costs include survey checks, boundary verification, and community charges. These expenses add up and must be set in place.

Buyers also pay for access roads, clearing, and basic site preparation. Ignoring these costs inflates the real cost start real estate business later.

Smart investors plan beyond the advertised price. Accounting for hidden costs early protects cash flow and prevents stalled projects.

Legal and Documentation Costs

Legal and documentation expenses are a critical part of the cost start real estate business in Anambra. Many beginners overlook this stage because costs come later. Yet, skipping or delaying documentation often leads to disputes and financial loss.

In 2026, documentation costs protect ownership and resale value. They confirm boundaries, confirm sellers, and secure your interest in the property. While these expenses increase startup costs, they reduce risk and improve long-term confidence.

Certificate of Occupancy, Deed of Assignment, and Survey fees

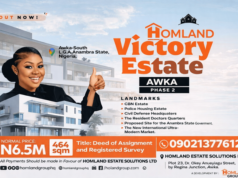

Buyers should know the survey plan, deed of assignment, and Certificate of Occupancy. Each serves a different purpose and attracts its own cost.

Survey fees confirm land boundaries and location. A deed of assignment transfers ownership from the seller to the buyer. The Certificate of Occupancy provides government recognition of ownership. Together, they form the legal backbone of any property investment.

These documents raise the cost start real estate business, yet they protect capital. Properties without them face resale issues, disputes, and delays.

Cost of Verification and Due Diligence

Verification ensures documents are authentic and the land status is clear. This stage may involve surveys, physical inspections, and registry checks. Costs vary by location and complexity.

Skipping verification often looks like savings at first. Later, it leads to court cases, demolition risk, or loss of land. These outcomes multiply costs far beyond initial fees.

Investors who budget for verification early avoid stress and protect momentum.

Building and Development Costs

After land is in place, building costs dominate real estate startup costs in Anambra. Many beginners assume construction begins and ends with materials and labour. In reality, development involves several moving parts that affect budget and timeline.

In 2026, building costs reflect material prices, labour rates, and regulatory requirements. Planning these expenses early helps prevent stalled projects. It also allows you to decide whether to build immediately or hold the land for later development.

Cost of Construction Materials in Anambra

Construction materials account for a large share of the cost start real estate project. Prices fluctuate based on supply, transport, and demand. Cement, blocks, iron rods, roofing sheets, and fittings often increase without notice.

Urban projects usually attract higher material costs due to transport and labour demand. Developing areas may reduce some costs, but access issues can offset those savings. Buying materials in phases helps manage cash flow and limit waste.

Smart investors check price trends and buy at strategic times. This approach controls cost and reduces pressure during construction.

Labour, Approvals, and Project Management Expect

Labour cost depends on skill level, project size, and duration. Skilled artisans charge more but reduce mistakes and rework. Cheaper labour often increases delays and hidden expenses.

Approval fees and inspections also add to development costs. These ensure compliance and prevent demolition risks. Project management expenses cover supervision, coordination, and quality control.

Together, these items raise the cost start real estate project, yet they protect the project. Proper management keeps timelines realistic and budgets controlled.

Alternative Ways to Start with Lower Capital

Not everyone entering property investment in 2026 has large savings. As a result, there are good paths that reduce the cost to start real estate without added risk. These options focus on shared ownership, phased entry, and controlled growth.

Lower-capital strategies work best when expectations are clear. Returns may be slower at first, yet risk is easier to manage. For many beginners, these routes provide practical entry without financial strain.

Joint Ventures and Land Banking

Joint ventures allow investors to pool funds and share ownership. This reduces individual capital pressure and spreads risk. Clear agreements are essential to define roles, profit sharing, and exit terms.

Land banking is another lower-capital strategy. Investors buy land in developing areas and hold it over time. Entry cost is lower, but returns depend on infrastructure growth and patience.

Both methods cut the cost start real estate business but need discipline.

Buying from Registered Real Estate Companies

Registered companies often offer structured payment plans and clearer documentation. While prices may be higher, risk is lower due to defined processes.

For beginners, this route simplifies verification and reduces setup time. It also supports gradual payments, which lowers entry barriers. Although this increases the upfront price, it can reduce total cost by avoiding disputes.

Choosing reputable companies helps balance affordability with safety.

Common Costly Mistakes New Investors Make

Many first-time buyers enter the market with enthusiasm but limited preparation. These errors inflate the cost start real estate business and delay progress. Recognising common mistakes early helps you protect capital and move with confidence.

Most costly errors fall into two groups. The first involves poor budgeting. The second comes from ignoring location-specific realities. Both are avoidable with proper planning.

Underestimating the Total Capital Required

A frequent mistake is budgeting only for land price. Beginners forget documentation, verification, and setup costs. When these appear later, projects stall.

Underfunding also forces rushed decisions. Investors may skip verification or choose cheaper labour. These shortcuts often increase total cost over time. Planning the full cost start real estate upfront prevents this cycle.

Ignoring Location-Specific Cost Factors

Costs change from one area to another. Infrastructure access, land title quality, and demand all affect price and speed. Ignoring these factors leads to unrealistic expectations.

For example, cheaper land may lack access roads or utilities. Fixing these later increases cost and delays returns. Understanding local conditions helps align the budget with reality.

Avoiding these mistakes keeps your investment steady and predictable.

Is Starting Real Estate in Anambra Worth the Cost in 2026?

By this point, the cost start real estate in Anambra should feel clearer. What matters now is whether those costs make sense relative to expected returns. In 2026, demand and urban growth shape the market statewide.

For investors who plan with care, the numbers can work. Land values continue to respond to infrastructure expansion. Rental demand remains steady in urban and growing areas. These factors support returns that justify startup costs when risk remains under control.

Cost Versus Return Outlook

Returns depend on entry strategy and location choice. Urban areas demand higher capital but support faster rental income and resale. Developing zones reduces entry cost but requires patience.

When the startup cost aligns with the demand strength, returns become predictable. Misalignment creates delays and frustration. Knowing the full cost to start real estate guides smarter decisions.

Who This Investment is Best Suited For

Real estate in Anambra suits investors who prefer steady growth over quick wins. It fits those willing to plan, verify, and hold assets long enough for returns to mature.

In 2026, this market favours structured, asset-backed returns.

Conclusion

Starting property investment in Anambra in 2026 requires clarity, not guesswork. The true cost start real estate goes beyond land price. It includes documentation, verification, development, and planning.

The decision path is simple. Budget in full, choose locations with demand, and avoid shortcuts that increase risk. When these align, real estate becomes a stable path to long-term value.

Do you want clarity before investing to avoid costly mistakes? Contact us on WhatsApp for real estate guidance https://wa.me/+2349021377612