Building houses rent Awka targets steady rental income. Awka’s housing market no longer behaves like a slow-growing state capital. Every year, more civil servants, business owners, and remote workers move in, and most of them rent. Demand outpaces supply for quality rentals.

For investors, this shift raises a key question. Does building houses rent Awka still make financial sense today? This article answers that using real market signals and local examples.

You will see ten clear reasons why rental property in Awka remains attractive in 2026. It also shows how to avoid costly investment mistakes.

Awka’s Growing Population and Rising Housing Demand

Awka’s population growth is not accidental; it sustained by function. As the state capital, the city pulls people in for work, education, and administration. Each new intake increases rental demand, as most newcomers rent first

This steady inflow supports building houses rent Awka as a long-term strategy.

Government ministries and private firms use thousands of people who earn monthly salaries. Most of them need housing close to work. Students and young professionals prefer smaller units near campuses and work areas.

In practical terms, demand does not collapse during off-seasons. Landlords often secure tenants within weeks, not months. As a result, vacancy risk stays low compared to many nearby towns.

This matters because population-led demand is more reliable than speculation. When people live near work and school, rent remains a priority, even in tough times.

Building Houses Rent Awka & Consistent Rental Income From Tenants in Awka

Rental income in Awka benefits from one key advantage: predictability. Most tenants are salary earners, traders, or professionals with regular cash flow. Rent follows monthly income cycles, so payment patterns remain stable throughout the year.

This stability reinforces building houses rent Awka as an income-focused investment.

In many Awka neighbourhoods, standard flats are on annual terms, paid upfront. One tenant can cover a full year’s return in a single transaction. For investors, this reduces collection stress and improves cash planning.

But, rent reviews are gradual but consistent. As infrastructure improves and demand grows, landlords adjust rents upward without sharp resistance. Over time, these compounds return in a way fixed-income assets cannot.

The practical takeaway is simple. When rental income aligns with how people earn and live, default risk drops. That reliability is what separates sustainable rental markets from speculative ones.

Building Houses Rent Awka & Lower Building Cost Compared to Lagos and Abuja

Building rental housing in Awka costs less than in Lagos or Abuja. Land prices are lower. Labour and approvals also cost less. This reduces the total amount investors need to start.

A standard block of six flats can be in Awka at a lower cost than in major cities. At the same time, rental demand remains strong. This creates a healthier gap between build cost and rental income.

Skilled artisans are available in Awka. This reduces construction delays. Approval processes are also faster, which lowers holding costs during development.

Lower build costs shorten the breakeven period. As a result, long-term risk falls. Rental income helps investors recoup their capital faster, and profit stability improves.

Building Houses Rent Awka & High Demand for Self-Contained and Mini Flats

Rental demand in Awka is not spread across all unit types. Students, junior civil servants, and young professionals prefer smaller units. These groups rank affordability, privacy, and proximity to daily activities.

Matching layouts to demand improves building houses rent Awka.

Self-contained rooms and mini flats are easier to fill than large apartments. They cost less per unit and produce a higher rental yield. Often, five smaller units outperform two large flats on the same land size.

Turnover also works in the landlord’s favour. When tenants upgrade or move, replacements appear without delay. Demand from first-time renters stays strong year-round.

The lesson is practical. Matching unit size to lifestyle patterns reduces vacancies and stabilises cash flow.

Building Houses Rent Awka and Government Presence & Civil Service Employment

Awka’s role as a state capital creates stable employment. Government ministries and parastatals use a large share of the city’s workforce. Jobs are not temporary, which supports long-term rental demand.

This stability makes building houses rent Awka a low-risk investment.

Most civil servants rent near their offices to cut transport time. Even as postings and promotions change, demand stays local. Creates steady tenant circulation without shrinking demand.

Salary-backed employment also improves payment reliability. Tenants with predictable incomes default less often. For landlords, this reduces disputes and improves annual planning.

Markets anchored by government jobs outperform only commercial towns during downturns.. That defensive quality is valuable for long-term investors.

Fast Tenant Turnover and Low Vacancy Rates

In Awka, vacant rental units rarely stay empty for long. When a tenant leaves, demand returns immediately in accessible locations. This fast turnover reduces income gaps that often hurt rental investments.

This pattern further supports building houses rent Awka as a dependable strategy.

Several factors drive low vacancy rates. Proximity to ministries, schools, markets, and transport keeps some areas in constant demand. Tenants always check listings and often secure apartments before renovations reach completion.

Even when tenants move, it is usually for upgrades, not exits from the market. That means existing renters and new entrants give way to other than lost demand. Over time, this keeps occupancy levels high.

For investors, low vacancy translates to a stronger annual yield. When rent flows always, he investment becomes easier to manage and forecast.

Building Houses Rent Awka & Strong Rental Returns in Key Awka Neighbourhoods

Neighbourhoods near government offices and tertiary institutions often achieve full occupancy faster. Tenants are willing to pay a premium to cut daily transport costs and time. Even modest upgrades, such as a steady water supply or parking, can justify higher rent.

Rental appreciation in these zones is gradual but steady. Landlords rarely need to slash prices to secure tenants. Instead, competitive demand allows for small, regular rent reviews.

Building Houses Rent Awka & Long-Term Property Value Appreciation in Awka

Rental income is only part of the investment picture. Property values in Awka always rise as urban growth and infrastructure improve. Property values in Awka always rise as urban growth and infrastructure improve. Investors who build and hold enjoy both cash flow and capital growth.

This dual benefit strengthens the logic behind building houses rent Awka.

As roads improve and new layouts emerge, once-overlooked areas become desirable. Properties that generate rent today often sell at higher values after several years. This appreciation serves as a secondary return layer in addition to rental income.

Unlike volatile markets, Awka’s growth is gradual. That reduces sharp price swings while allowing assets to compound value. Investors who enter early, in most cases, gain the most.

From a risk perspective, assets that earn while appreciating offer better downside protection. Even if rental growth slows for a short period, long-term value trends remain positive.

Building Houses Rent Awka & Flexible Rental Options (Short-Let and Long-Let)

Awka’s rental market allows flexibility that many investors overlook. Beyond traditional annual leases, short-let options are gaining traction. Visitors and project-based workers on the rise seek furnished spaces for short stays.

This flexibility strengthens building houses rent Awka with planning.

Long-term rentals provide steady income and low management stress. Short-lets, when well managed, can generate higher monthly returns from the same unit. Investors can also switch between the two models depending on demand cycles.

Planning strengthens building houses rent Awka. During quieter periods, the same units can revert to long-term leases. This adaptability improves income resilience.

The key is design and management readiness. Flexible planning creates many income streams from one property.

Building Houses Rent Awka & Building for Rent as a Hedge Against Inflation

Inflation erodes idle cash, but rental property responds in contrast. In Awka, rents rise over time as construction, transport, and living costs increase. This change protects investor income in real terms.

That protective quality is another reason building houses rent Awka remains attractive.

When construction costs increase, replacement housing becomes more expensive. Existing rental properties benefit because supply tightens while demand remains. Landlords can always review rents without losing tenants who face higher costs elsewhere.

Unlike fixed-income assets, rental property income is flexible. As economic conditions shift, rents adapt. This keeps returns aligned with real market conditions.

For investors thinking long-term, assets that respond to inflation offer stability. Rental housing in a growing city like Awka serves that defensive role without strain.

Conclusion

Building rental housing in Awka works because key forces align. Population growth drives demand, jobs secure rent, and low build costs protect capital. Together, these factors explain why building houses rent Awka delivers dependable results.

The decision path is clear. Choose demand-driven locations, build tenant-ready units, and plan for long-term ownership. When these align, rental property delivers income and preserves value.

This approach is not for short-term speculation. It suits investors seeking steady cash flow, controlled risk, and gradual wealth growth. If these match your goals, Awka’s rental market merits serious attention in 2026.

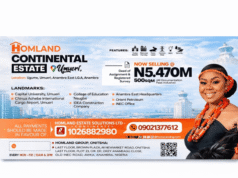

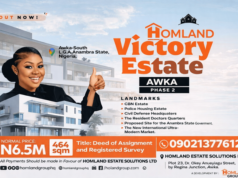

There are affordable estate properties in Anambra state. We can help you actualise your real estate goal. Chat us on WhatsApp for more inquiries https://wa.me/+2349021377612